The financial future you want starts now

There’s an option for every stage of your investment journey. We’re here to help you build your wealth, one step at a time.

Fees as low as 0.2%

New investor? Enjoy a 3-month fee waiver*!

See pricing

StashAway Management (DIFC) Limited is regulated by the DFSA (license number F006312).

Earn a projected 4.1%* p.a. on any amount with StashAway Simple™

Why choose Simple?

*The projected rate is not guaranteed and is as of 15 Jul 2025. It is based on the Gross Yield provided by the fund manager.

Proven performance: See our historical returns

Portfolio Type

General Investing powered by StashAway

Risk level

18%

Lower Risk

Higher risk

Powered by technology. Invested by experts. Driven by you.

No time to sift through endless financial news articles?

Sign up for Weekly Buzz: The only financial E-newsletter you need.

What do you want to do with your money?

Wherever you are in your investment journey, we have the investment options you need to grow into your investments.

General Investing powered by StashAway

General Investing powered by BlackRock®

StashAway Simple™

Responsible Investing with ESG

Flexible Portfolios

We’ve made it easy for you to invest

We’re more than just investments

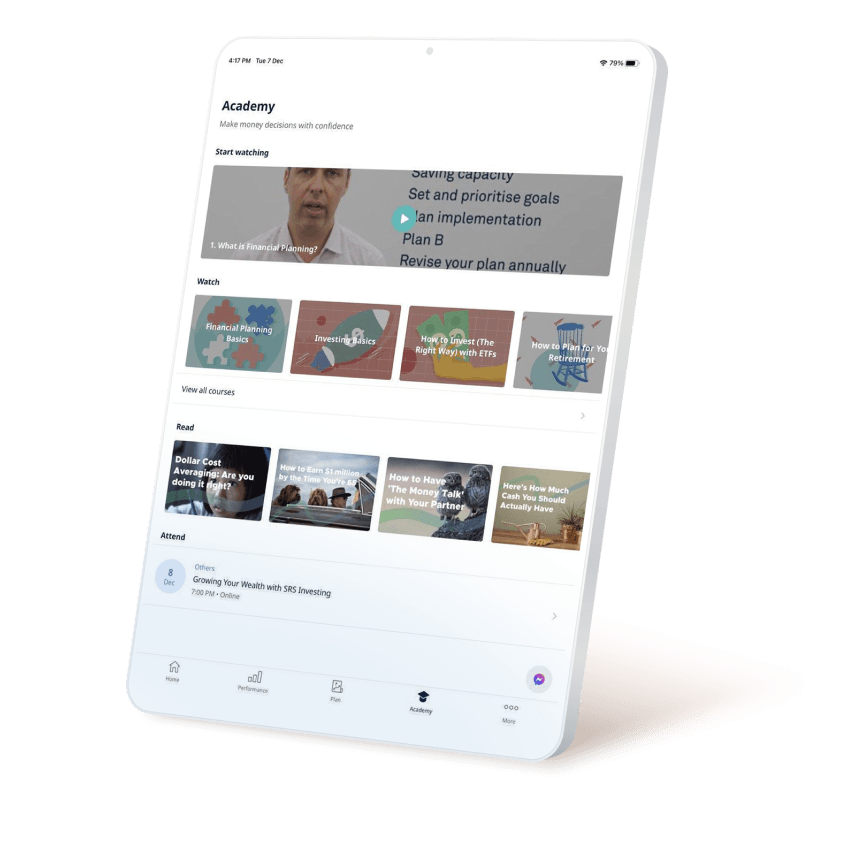

Learn

Save

Don’t just take our word for it

$1 billion+ USD

2,000+

Build your wealth today

Start investing from as little as you want.

Frequently Asked Questions

Is there a minimum deposit or fixed amount I need to invest?

For SGD deposits, there is no minimum deposit amount required.

However, for USD deposits, there is a minimum deposit amount of $10,000 USD per deposit.

You have full discretion on how much and when you want to invest, including no minimum balance to maintain the account. You may also skip a month or two, resume, and withdraw whenever you wish. All without incurring charges or penalties.

*Note : For Income portfolio, there is a minimum balance required of SGD10,000.

What are the fees associated with StashAway?

The annual management fee is calculated as a percentage of the total assets under management, ranging from 0.2% - 0.8%, and is charged monthly on a pro-rata basis. i.e if you invested on the 15th of a particular month, we will not charge you for the first 15 days.

The other fee included is the low fee associated with the ETFs, averaging 0.15% - 0.25%.

Additionally, for non-USD deposits to USD portfolios, our vendor will apply the current interbank rates for all currency conversions, ensuring the lowest cost possible.

Unlike most traditional financial managers, we do not (and never will) charge for withdrawals or account closures. More details on how StashAway can charge low fees can be found here.